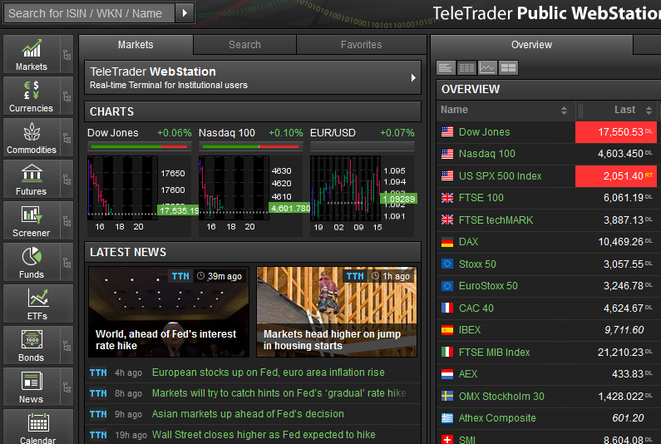

мониторинг Фин. маркта

внимание данные не соответствуют реальности, для мониторинга Фин. маркта нажмите на ссылку

Мониторинг Идей

TradingView Ideas

$RDUS ( Bullish ) Long Term Setup (Thu, 21 Nov 2024)Had this ticker in my watch list. Setup looks good to go long. Key resistance is support now.. lets see if it holds

>> Read More

Gold Intraday Trading Plan 11/22/2024 (Thu, 21 Nov 2024)

Gold has been traded in a channel again. In 12 hourly TF, it has also completed one full Elliot wave. A downward push is imminent. I am expecting price to touch at least lower bound of the channel today which could be around 2652.

>> Read More

BTC, Month, then correction (Thu, 21 Nov 2024)

BTC, Month, then correction bitcoin will reach range 105-106 USD, then correction

>> Read More

LONG FIS @ 85.50 - oversold in a falling wedge (maybe) (Thu, 21 Nov 2024)

NYSE:FIS is another decidedly unsexy and counterintuitive stock that I love to trade. It's pretty boring, except when it's not. It's in a year long uptrend so that alone is attractive. That falling wedge referenced in the title isn't particularly relevant to MY trade thesis but maybe it would be sexy for some of you. For me it is about being oversold and what this stock has been doing when it is. Over the past 12 months, it would have produced 18 oversold trade signals. Unsurprisingly for me, all 18 would have been profitable trades. What is most compelling for me, though, is that the longest any of them would have taken to become profitable is 6 trading days, with the average being 2.27 days using FPC. I didn't bother to calculate the average win exactly, but 4 of the trades were over 1%, 2 were over 3%, and one was over 5% - and those were all one day trades. When all you have to do to beat the market long term is average >.042% per day, this trade is a no-brainer for me. All the 11 other trades could have been just 0.1% gainers (they weren't) and it would still be an average of over 1% per trade and at 2.27 days/trade we are talking an average gain per day of at LEAST .44% or 10x the average day in the market as a whole. Sign me up again and again and again for that. .44% per day is 111% per year, in case you were wondering. As always, I'll add whenever it's oversold and with FPC, I'll sell any lot at the close of the first day it becomes profitable. This isn't trading advice - DYOR. It is merely one man's musings on how I might make money in the coming days faster than the market as a whole while risking far less than having all my money parked there. Follow in my footsteps at your own risk, but if you do, I wish you luck.

>> Read More

$SOL Taps ATH at $260 !!! (Thu, 21 Nov 2024)

4 days later, and CRYPTOCAP:SOL taps its ATH at $260 Price Discovery here we come! HIGHER

>> Read More

OPUS next x100 memecoin (Thu, 21 Nov 2024)

When people find out about OPUS, this is going to run very hard

>> Read More

URA - Looking Good for Major Move (Thu, 21 Nov 2024)

The URA base appears to be a major reverse head and shoulders formation with price projections into the 40s. The move thus far appears to be impulsive with wave 5 targets also shown at the 1 and 1.618 levels. Still appears to be under the radar

>> Read More

EURJPY SWING LOW (Thu, 21 Nov 2024)

The Uptrend was finished and formed higher lows and the trend is unable to break the red trendline. It's very bearish. 4hr time frame shows the candles close below support and resistance zone which is confirmed again it's bearish. Trend is under 50 EMA for the last 2 weeks, also very bearish. SL is placed behind the support and resistance zone @162.90 Entry is placed @161.823 TP is @155.30

>> Read More

BTCUSDT (Thu, 21 Nov 2024)

BTC will touch 100k and above based on the structure can have more upswing before consolidation

>> Read More

I can't unsee this triple 1-2 playing out $mstr (Thu, 21 Nov 2024)

Self-explanatory - Elliot Wave, Nested 1-2's for MSTR - Time isn't accounted for in future waves... but assume through bitcoin cycle late into next year

>> Read More

Nordic Semiconductor ASA | Chart & Forecast Summary (Thu, 21 Nov 2024)

Key Indicators On Trade Set Up In General 1. Push Set Up 2. Range Set up 3. Break & Retest Set Up Notes On Session # Nordic Semiconductor ASA - Bias 1 | Resistance | Support | Uptrend Hypothesis - Bias 2 | Triangle | Short Set Up - Wave 1 & Wave 2 | 12345 - Double Top | Bias 1 | Target Template Feature - Double Top | Awaiting Target Active Sessions On Relevant Range & Elemented Probabilities; London(Upwards) - NYC(Downwards) Conclusion | Trade Plan Execution & Risk Management On Demand; Overall Consensus | Sell

>> Read More

#xauusd #elliottwave long buy setup wave 5 15m 22Nov24 (Thu, 21 Nov 2024)

This count is based on my assumptions so anything can happen not a trading or financial advice just for educational purposes only kindly do your own ta thanks trade with care good luck.

>> Read More

Bearish drop off overlap resistance level? (Thu, 21 Nov 2024)

COPPER has reacted off the resistance level which is an overlap resistance and could drop from this level to our take profit. Entry: 4.1258 Why we like it: There is an overlap resistance level . Stop loss: 4.2071 Why we like it: There is a pullback resistance level that aligns with the 50% Fibonacci retracement. Take profit: 4.0203 Why we like it: There is a pullback support level. Enjoying your TradingView experience? Review us! Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

>> Read More

MASKUSDT LOOOOONG (Thu, 21 Nov 2024)

figure is clear enough. you can open long with 15x and set sl on 2.85 and tp on 3.74 this is a financial advise be lycky

>> Read More

ADA NEXT RUN (Thu, 21 Nov 2024)

according to pattern of cycle that how fall and rise to new levels , we can have same pattern including double bottom and breaking resistance levels and reaching to new prices . ex cycle remained 4 months and we expect new cycle done in 3 or 4 months and reaching to 12$

>> Read More

If the price is maintained above 3321.30, ATH is possible (Thu, 21 Nov 2024)

Hello, traders. If you "Follow", you can always get new information quickly. Please also click "Boost". Have a nice day today. ------------------------------------- (ETHUSDT 1D chart) https://www.tradingview.com/x/VzX36Qlb/ It has broken through the important resistance area of 3265.0-3321.30. Accordingly, if it shows support near 3321.30, it is expected to continue to rise. In other words, the key is whether it can break through the 3438.16 and 3644.71 points. If it does, it is expected to continue to rise to renew the ATH. I think this rise is meaningful because I think that for the altcoin bull market to start, the rise of ETH must start first. - Have a good time. Thank you. -------------------------------------------------- - Big picture I used TradingView's INDEX chart to check the entire range of BTC. (BTCUSD 12M chart) https://www.tradingview.com/x/WBuhqVrT/ Looking at the big picture, it seems that it has been maintaining an upward trend following a pattern since 2015. In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market. Accordingly, the bull market is expected to continue until 2025. - (LOG chart) https://www.tradingview.com/x/YtZx6YSG/ Looking at the LOG chart, you can see that the increase is decreasing. Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective. Therefore, it is expected that prices below 44K-48K will not be seen in the future. - https://www.tradingview.com/x/zTnWN2r7/ The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015. In other words, it is the Fibonacci ratio of the first wave of the uptrend. The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019. Therefore, it is expected that this Fibonacci ratio will be used until 2026. - No matter what anyone says, the chart has already been created and is already moving. It is up to you how to view and respond to this. If the ATH is renewed, there are no support and resistance points, so the Fibonacci ratio can be appropriately utilized. However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous to use it as support and resistance. The reason is that the user must directly select the important selection points required to generate Fibonacci. Therefore, since it is expressed differently depending on how the user specifies the selection points, it can be useful for chart analysis, but it can be seen as ambiguous to use it for trading strategies. 1st: 44234.54 2nd: 61383.23 3rd: 89126.41 101875.70-106275.10 (when overshooting) 4th: 134018.28 151166.97-157451.83 (when overshooting) 5th: 178910.15 -----------------

>> Read More

Optimism is determined to conquer the heights! $OP (Thu, 21 Nov 2024)

Everything here is beautiful! From technical analysis to blockchain analysis. I can see us moving in a parallel channel, where when combined with fibonacci we come to the 1.618 level right to the upper limits of this price channel. I would expect a value low in the area of $3.5 per coin with the most positive scenario expecting $7.1 per coin. I see the presence of a number of prominent Market Makers in the blockchain, but I don't like the contingent that holds this asset. Perhaps over time people will become disillusioned with the L2 range and sell their coins to a Marketmaker. Thus setting the stage for a hands free flight! Best wishes, Horban brothers!

>> Read More

Buyers are here but (Thu, 21 Nov 2024)

Buyers are here in the S&P 500 daily chart but can they maintain this momentum going into the weekend with a positive close. 6000 is the next objective for a close going into the weekend.

>> Read More

dont take any trade now a goodn trader knows when to sit on his (Thu, 21 Nov 2024)

sit on your hands now and wait for asian session FX:GBPUSD $FXOPEN:XAUUSD. I am on a journey to flip 100 usd to 100k USD. Trust me, YOU should learn TO SIT ON YOUR HAND. THE BEST TRADE COME TO THOSE WHO WAIT .................................................... ... ....

>> Read More

Sol Extremely Bullish Fractal (Thu, 21 Nov 2024)

Hi Please click like So this is as fractal from previous bull run in 2021, and used the same fibonacci targets for this bull run. The chart here is SOLBTC, so if peak on this chart is 0.01BTC and BTC today is 100K = SOL 1k. If BTC peak is 200K -> Sol is 2K... etc. ---- This is a dreamy target, but it is in my opinion important to have some extreme targets. I have been in crypto for 7 years, and havent we all seen extreme things happen ? Perhaps this could be possible with SOL "eth killing" and taking the coin nr 2 place ? Watch below some other SOL vs ETH ideas. It looks.. possible.. Or ? What do you think ?

>> Read More

Bearish drop? (Thu, 21 Nov 2024)

EUR/GBP is reacting off the resistance level which is an overlap support and could drop to our take profit. Entry: 0.8322 Why we like it: There is an overlap support level. Stop loss: 0.8340 Why we like it: There is an overlap resistance level. Take profit: 0.8300 Why we like it: There is an overlap support level that lines up with the 138.2% Fibonacci extension. Enjoying your TradingView experience? Review us! Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

>> Read More

Sideways are the point of interest until around December 3rd (Thu, 21 Nov 2024)

Hello, traders. If you "Follow", you can always get new information quickly. Please click "Boost" as well. Have a nice day today. ------------------------------------- (BTCUSDT 1D chart) https://www.tradingview.com/x/OOGIWANd/ The Fibonacci ratio on the left was drawn in the first rising wave. Therefore, I think it is highly likely that it will sideways around 3.618 (98841.11). I think this sideways movement is likely to continue until around December 3rd during the next volatility period. If it continues to rise, it is expected to touch around 1.902 (101784.54) ~ 2 (106178.85). - (BTC.D 1M chart) https://www.tradingview.com/x/xCibea6g/ If BTC dominance rises above 62.47, I think a market where only BTC rises could be created. Therefore, whether it can fall is the key. - Have a good time. Thank you. -------------------------------------------------- - Big picture I used TradingView's INDEX chart to check the entire range of BTC. (BTCUSD 12M chart) https://www.tradingview.com/x/WBuhqVrT/ Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015. That is, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend. Accordingly, the uptrend is expected to continue until 2025. - (LOG chart) https://www.tradingview.com/x/YtZx6YSG/ As you can see from the LOG chart, the uptrend is decreasing. Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective. Therefore, we expect that we will not see prices below 44K-48K in the future. - https://www.tradingview.com/x/zTnWN2r7/ The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015. In other words, it is the Fibonacci ratio of the first wave of the uptrend. The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019. Therefore, this Fibonacci ratio is expected to be used until 2026. - No matter what anyone says, the chart has already been created and is already moving. It is up to you to decide how to view and respond to this. When the ATH is updated, there are no support and resistance points, so the Fibonacci ratio can be used appropriately. However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous when used as support and resistance. This is because the user must directly select the important selection points required to create Fibonacci. Therefore, since it is expressed differently depending on how the user specifies the selection points, it can be useful for chart analysis, but it can be seen as ambiguous when used for trading strategies. 1st : 44234.54 2nd : 61383.23 3rd : 89126.41 101875.70-106275.10 (Overshooting) 4th : 134018.28 151166.97-157451.83 (Overshooting) 5th : 178910.15 -----------------

>> Read More

Alt Season Begins as Bitcoin Clears Final Trend (Thu, 21 Nov 2024)

Today might just mark the start of Altcoin Season. With BTC breaking its final trendline resistance and heading toward the 1.272 Fibonacci extension ($103,616), the stage is set for altcoins to take center stage. Total2 (Altcoin Market Cap excluding BTC) has cleared a critical resistance zone, and ETH/BTC has hit a significant level, signaling a shift in market dynamics. Historically, when Bitcoin dominance peaks during parabolic moves, liquidity flows into altcoins, fueling explosive gains. The fractal overlay on BTC suggests this cycle could fast-track into Q1 2025, aligning with a potential altcoin rally starting now. If you’re positioned in quality altcoins, this is the moment to watch closely. Momentum is building across the board. With Total2 breaking out, the conditions are primed for a significant altcoin surge to follow Bitcoin’s lead. Altcoin Season starts now – don’t get left behind.

>> Read More

Bearish reversal? (Thu, 21 Nov 2024)

AUD/CHF is rising towards the resistance level which is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could reverse from this level to our take profit. Entry: 0.57896 Why we like it: There is a pullback resistance level that aligns with the 61.8% Fibonacci retracement. Stop loss: 0.58224 Why we like it: There is a pullback resistance level. Take profit: 0.57508 Why we like it: There is an overlap support level. Enjoying your TradingView experience? Review us! Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

>> Read More

BTC bearing divergence (Thu, 21 Nov 2024)

Careful, Btc is creating higher highs but the RSI is printing lower high, Losing in strength!!!

>> Read More

Why FET/USD looks like ETH/BTC ?? (Thu, 21 Nov 2024)

noticed this this morning maybe there is a very simple explication, feel free to share it, I'm not a pro charter so I'll not be able to put the pic of ETH/BTC directly on the chart but here is it https://www.tradingview.com/chart/ETHBTC/Zp3J6duy-ETH-BTC-A-potential-path-for-the-next-9-months/ timeframes are different but there remains proportionals it's a pattern that consists in : - a vertical move (early 2024 for FET, early 2016 for ETH) - a distribution that bring us to a higher low from before that vertical move (Low for FET was 6 august 2024, for ETH/BTC early September 2019) - a move up that create a inverse H&S, that distribution is the left leg - another distribution from that previous move that finished this month for both pairs, yesterday was THE low for ETH/BTC if my whole idea is working, it was a local low for FET/USD but this one touched the channel where FET is evolving + it's a 0.5 fib retracement from previous move up TP 15???¿

>> Read More

$BITCOINUSD (Thu, 21 Nov 2024)

update on this shitcoin position i am anticipating a serious of higher highs to start soon, higher forever confirmation is getting above 30 cents

>> Read More

Heading into 50% Fibonacci resistance? (Thu, 21 Nov 2024)

NZD/CHF is rising towards the resistance level which is a pullback resistance that aligns with the 50% Fibonacci retracement and a reversal from this level could indicate a double top pattern which might lead to a potential price drop to our take profit. Entry: 0.52198 Why we like it: There is a pullback resistance level that aligns with the 50% Fibonacci retracement. Stop loss: 0.52375 Why we like it: There is a pullback resistance level that aligns with the 127.2%^ Fibonacci extension. Take profit: 0.51805 Why we like it: There is a pullback support level. Enjoying your TradingView experience? Review us! Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

>> Read More

2024-11-21 - priceactiontds - daily update - dax (Thu, 21 Nov 2024)

Good Evening and I hope you are well. tl;dr dax xetra - Bullish. 3 times bears tried to close below 19000 and failed. Today bears only printed a higher low and the chances for the bulls are good to get above 19260, test 19360 and then melt above to 19600+. If my thesis is correct, market will not drop much again overnight or tomorrow. Anything below 19140ish is probably invalidation for that. If bears do it again, also a decent chance that bulls give up and we finally see a bigger down move but for now I heavily favor the bulls. comment : Will get a bit whacky now but bear with me. I do think today was W1 of a 5-wave series where W3 will lead to 19450ish and the bear trend line and W5 will lead to 20k because a measured move up from my W3 is almost exactly 20k. So if that will happen, you are welcome. I think the current structure is a simply if this then that case. Market stays above 19000, we will likely break above 19200 for 19450 and so forth. If we print below 19000 again, bulls might give up and we flush down in a bigger move. One side has to give tomorrow and I heavily favor the bulls. current market cycle: trading range key levels: 18800 - 20000 bull case: Bulls closed above the first bear trend line and it was another huge reversal day. Bears tried 3 times and it’s time to give up and find more sellers at higher prices. It’s entirely possible that this market will trade between 18800 and 19300 for the next year. Always be open to many possible outcomes. Invalidation is below 18869. bear case : Bears still see the trend line as not broken enough and they are still printing lower highs and as long as that is the case, they have made money selling highs and they will continue to do so. Problem for the bears is the higher low from today and that the market closed at the highs. If they manage to get below 19000 again, their odds rise and it’s possible that more bulls give up and we see a bigger move down. Invalidation is above 19310.. short term: Bullish. Want to see 19300 and maybe 19400+ tomorrow. Everything below 19000 means I’m wrong and we either chop until world ends or flush down. medium-long term - Update from 2024-10-19: 20000 is the goal for 2024, if bulls do not get it until year end, it will probably not happen for the next 5-10 years. This market is beyond overvalued and will drop 30-50% in the next 5 years. I have no doubts about that. That fact should not be relevant to your trading at all. current swing trade: None trade of the day: Very risky longs around 19000 with a wide stop below y low but they paid.

>> Read More

GRT (Thu, 21 Nov 2024)

Get usdt Daily analysis Time frame daily Get breaks the strong (gray) resistance on 0.022$ And I guess next target is 0.031$

>> Read More