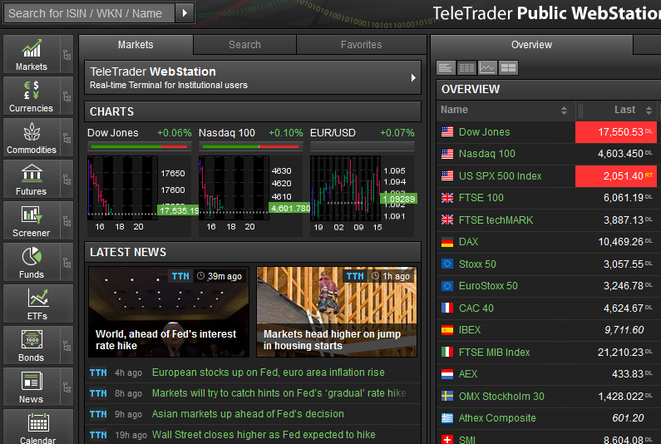

мониторинг Фин. маркта

внимание данные не соответствуют реальности, для мониторинга Фин. маркта нажмите на ссылку

Мониторинг Идей

TradingView Ideas

GBPUSD DROP MORE (Mon, 06 May 2024)I think GU possible to drop more. Trade at your own risk.

>> Read More

ICT Mentorship 2022 Chart Analysis (Mon, 06 May 2024)

Using the attack plan of ICT mentorship 2022, after today's analysis the market would be bearish due to the gap on the daily. after we took the buyside liquidity area, we waited for a break in the market structure and after that we should look for a gap where we will execute the trade.

>> Read More

NFLX looking to Gap fill to the upside (Mon, 06 May 2024)

NFLX on the Daily time frame seems to be going for gap fill to the upside now. Immediate targets would be 585/590 and 605 eventually Stops below 573 CMP 581 (pre-market)

>> Read More

GBPAUD: Long Trade with Entry/SL/TP (Mon, 06 May 2024)

https://www.tradingview.com/x/46ypHW3p/ GBPAUD - Classic bullish formation - Our team expects growth SUGGESTED TRADE: Swing Trade Buy GBPAUD Entry Level - 1.8971 Sl - 1.8882 Tp - 1.9135 Our Risk - 1% Start protection of your profits from lower levels ❤️ Please, support our work with like & comment! ❤️

>> Read More

GBPNZD Technical Analysis! BUY! (Mon, 06 May 2024)

https://www.tradingview.com/x/iHZlmnWD/ My dear friends, Please, find my technical outlook for GBPNZD below: The price is coiling around a solid key level - 2.0890 Bias - Bullish Technical Indicators: Pivot Points Low anticipates a potential price reversal. Super trend shows a clear buy, giving a perfect indicators' convergence. Goal - 2.1001 About Used Indicators: The pivot point itself is simply the average of the high, low and closing prices from the previous trading day. ——————————— WISH YOU ALL LUCK

>> Read More

AUDUSD Short Trade Setup (Mon, 06 May 2024)

A #short trade opportunity recently presented itself on the #aussiedollar (#AUDUSD) #trading chart . This is indicated by the #bearish harami candlestick ️ pattern just below the 0.66462 horizontal resistance level. This indicates a rejection of the same level, with potential price move in the downward ⬇️ direction (#sell). Sufficient downward momentum should see price dumping towards the 0.65000 psychological level and possibly testing the strength of the 0.64647 horizontal support level. As always, please apply appropriate risk management. Happy trading! #majorpair

>> Read More

LONG is the way to go (Mon, 06 May 2024)

Easy money, the market is going to explode like a rocket after we hit the 18k line.

>> Read More

Gold has opened the pathway. (Mon, 06 May 2024)

Gold has opened the pathway. It is now up to the gold and silver miners to follow suite! #gold #silver AMEX:GDX #gdxj AMEX:SILJ #miners

>> Read More

Black Swan - Bullische Reaktion bei einem interessanten Wert (Mon, 06 May 2024)

Ein Wert den ich schon etwas Länger auf der Watchliste habe ist jetzt eine bullische Reaktion eingetreten und ich vermute hier aufgrund des Black Swans einen längerfristigen Follow through.

>> Read More

BTC Bearish Divergence (Mon, 06 May 2024)

Proceed with slight caution. Just as bullish divergence has shown us the bottoms, bearish divergence often shows us the tops - and we have that right now. Becareful on lower time frames here.

>> Read More

#RLC/USDT - Long - Potential 47.42% (Mon, 06 May 2024)

Strategy: Long Exchange: BINANCE Account: Spot Entry mode: Market order in range Invest: Risk 1% Exit: • ⎿ Target 2 : 4.747 47.1% • ⎿ Target 1 : 3.588 11.19% Entry: 3.227 ⌁ 3.227 • ⎿ Current market price: 3.227 Stop: 2.753 (-14.69%) Technical indicators: Volume pump, RSI momentum, crossing 20 & 50 MA • ⎿ 24h Volume: 11176946.9429 • ⎿ Satoshis: 3.227 • ⎿ Analysis: TradingView

>> Read More

#CADJPY: 800+ Pips Possibly The Next Big Movement to Occur (Mon, 06 May 2024)

Dear Traders, Likewise our GBPJPY idea we also expect the similar movement on CADJPY, due to JPY recent bullish price correction, price of JPY pairs dropped heavily, however, the good thing is price rebounding from a vital key level which may be a turning point that buyers were looking for. Please note, today there is bank holidays in the uk and japan.

>> Read More

EURGBP Expected Growth! BUY! (Mon, 06 May 2024)

https://www.tradingview.com/x/EoEaXUzG/ My dear friends, My technical analysis for EURGBPis below: The market is trading on 0.8566 pivot level. Bias - Bullish Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation. Target - 0.8574 About Used Indicators: A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames. ——————————— WISH YOU ALL LUCK

>> Read More

Bitcoin Weekly Range Sweep (Mon, 06 May 2024)

Bitcoin printed a lovely weekly candle - a hammer with a long wick down and small bullish body. This is often a sign of strengthening demand (buyers buying up the dips) and of a bullish reversal. That said, this is still just trading in a range, with price sweeping those range lows on higher time frames. Not much to get excited about until we break through the range highs, which is far away at the moment. The sweep of the lows is encouraging - usually that means we eventually test the top of the range as well.

>> Read More

BF Borgers auditor for Trump Media - Coincidence don't think so (Mon, 06 May 2024)

https://www.washingtonpost.com/technology/2024/05/03/trump-media-auditor-borgers-suspended-permanently/ Now they need to find a reputable firm, the financials will be more reflective of the ACTUAL heath of the company

>> Read More

#NKN/USDT - Long - Potential 33.52% (Mon, 06 May 2024)

Strategy: Long Exchange: BINANCE Account: Spot Entry mode: Market order in range Invest: Risk 1% Exit: • ⎿ Target 2 : 0.1685 33.1% • ⎿ Target 1 : 0.1337 5.61% Entry: 0.1266 ⌁ 0.1266 • ⎿ Current market price: 0.1266 Stop: 0.1121 (-11.45%) Technical indicators: Trendline break, cross above 200 & 20 MA's, RSI momentum. • ⎿ 24h Volume: 4439111.1445 • ⎿ Satoshis: 0.1266 • ⎿ Analysis: TradingView

>> Read More

Long trade (Mon, 06 May 2024)

Mon 6th May 24 7.00pm London Session Entry 0.16177 Profit level 0.20152 (24.57%) Stop level 0.15743 (2.68%)

>> Read More

Entries for long BTC on short timeframe (Mon, 06 May 2024)

https://www.tradingview.com/x/K3za9YDh/ We had a rejection of a monthly fresh order block. After a retest of this rejection we can see BTC hitting the orderblocks (white). We need to hold those area's and we start to place longs in for a possible scenario of BTC going into a trend past the alltime high. This will be a sweet spot as it is wave 3. Make sure you trade the end of wave C for the best entree depending on the correction later today and possibly tomorrow.

>> Read More

Doge Intraday Trade Setup (Mon, 06 May 2024)

The chart highlights breakout/rejection points, criteria, and targets to execute on the trade opportunity.

>> Read More

USDCHF (Mon, 06 May 2024)

**USDCHF:** This week's forecast is for the price to reach the key level at 0.92042 and then fall back to the bottom of the channel

>> Read More

⭐️ XAU/USD : $GOLD will fall ? (READ THE CAPTION) (Mon, 06 May 2024)

By examining the gold chart in the 2-hour time frame, we can see that the price on Friday, after growing up to $2320, faced a heavy selling pressure and fell from $2320 to $2277, that is, more than 420 pips of yield! Finally, gold closed at $2301 on Friday, and today we saw gold grow again to $2324. Now, as I indicated on the chart, gold is in the supply range of $2319.5 to $2328, and if the price cannot reach Above this level, we can expect more fall from gold, whose possible targets are $2312, $2303 and $2290, respectively! Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me ! Best Regards , Arman Shaban

>> Read More

GBPUSD (Mon, 06 May 2024)

**GBPUSD:** This week's forecast is for the price to test the key level at 1.2346 and climb back to the top of the channel

>> Read More

EURUSD (SENSTIVE MOVEMENT) (Mon, 06 May 2024)

The dollar slightly declined on Monday, influenced by a disappointing U.S. jobs report last Friday that fueled speculation about multiple Federal Reserve rate cuts this year. Meanwhile, the yen weakened following last week's presumed market intervention. The EURUSD pair gained ground on Friday and commenced the new week on a steady, albeit slow, trajectory after recent U.S. data jolted the forex markets. The Labor Department's latest nonfarm payrolls report revealed that U.S. employers added 175,000 jobs in April, significantly below the anticipated 238,000, thereby undermining confidence in the U.S. dollar. EURUSD New Outlook The price will trade in the bullish zone due to the high pressure, but also it is possible to do a retest till 1.0740 or 1.0700, and the bullish trend will continue toward 1.0807 and 1.08800 Pivot Price: 1.0760 Resistance Levels: 1.0808, 1.0880, 1.0945 Support Levels: 1.0707, 1.0668, 1.0610 The price is expected to oscillate between the support at 1.0707 and the resistance at 1.0880.

>> Read More

XAU (Mon, 06 May 2024)

**XAU:** The forecast is for the price to fall to the zone between 2179 and 2161.

>> Read More

SP500 (Mon, 06 May 2024)

**SP500:** The price is expected to fall to the zone between 4874 e 4824.

>> Read More

CrudeOil (Mon, 06 May 2024)

**CrudeOil:** The forecast for Crude this week is for the price to fall to the zone between 76.68 and 75.84, where we have a lost pivot, and then rise again.

>> Read More

EURUSD (Mon, 06 May 2024)

**EURUSD:** This week's forecast is for the price to fall to the zone marked between 1.05911 and 1.05582, the lower part of the channel close to a key level at 1.05566

>> Read More

EURUSD will Go Down by Ascending Broadening Wedge Pattern (Mon, 06 May 2024)

♂️ EURUSD is moving near the Resistance zone($1.0806-$1.0781) . According to Classical Technical Analysis , EURUSD seems to have succeeded in forming an Ascending Broadening Wedge Pattern . Also, we can see Regular Divergence(RD-) between two Consecutive Peaks . I expect EURUSD to at least decline to the Target I have marked on the chart. Euro/U.S.Dollar Analyze ( EURUSD), 1-hour Time frame ⏰. Do not forget to put Stop loss for your positions (For every position you want to open). Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post. Please do not forget the ✅' like '✅ button & Share it with your friends; thanks, and Trade safe.

>> Read More

A professional analysis might be able to help you (Mon, 06 May 2024)

After weeks of poor performance, new metrics have bounced back It's perfectly above all support levels and is poised to continue higher. If the Nasdaq can continue to hold 17,000 points in the future, it is expected to test 18,080-18,200 points within the year Near future. Any price above 18500 would open the door to higher targets 18650/19000/19200/19550 and higher. If NQ fails to hold 17,000 this week, expect a decline to test support 16500-15600/15250. Anything below 15250, future targets are 15000/14750/14500/14250-14000.

>> Read More

GOLD - Price can reach resistance line of channel and start fall (Mon, 06 May 2024)

Hi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments Some time ago price declined below $2375 level, which coincided with resistance area, but soon backed up and some time traded near. Later, Gold made downward impulse to support level, breaking $2375 level, after which price bounced up and started to fall in channel. In channel, XAU reached resistance line and then in a short time declined to support area, but soon rose back, making fake breakout. Next, Gold some time traded between $2300 level, and a not long time ago it bounced up from support area and now continues to grow. In my mind, Gold can reach resistance line and then bounce down to almost $2275 support line of channel, breaking support level. If this post is useful to you, you can support me with like/boost and advice in comments❤️

>> Read More